A GST-registered dealer must issue a GST invoice or bill when supplying taxable goods or services. The invoice must comply with GST rules and regulations. It is typically used to charge tax and to claim input tax credit.

GST billing and invoicing are made easy and simple with GST billing software. Invoices can be generated as per GST rules and issued to customers quickly. Let’s take a closer look at the mandatory fields required in a GST invoice or bill according to GST regulations.

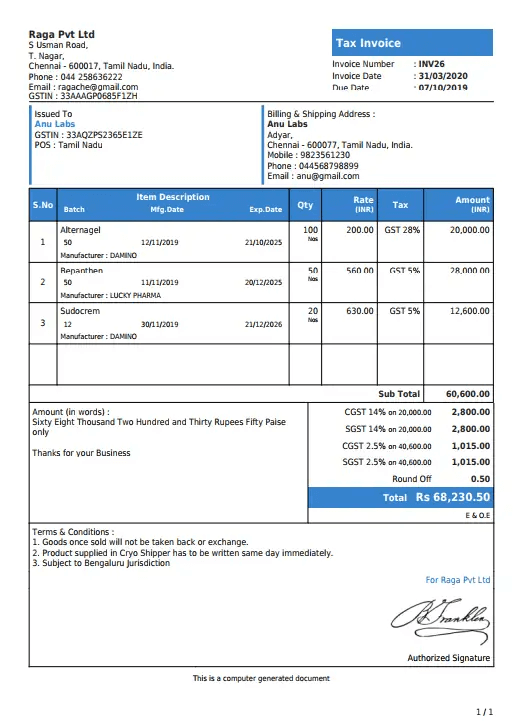

GST Invoice Format

A detailed professional Tax Invoice under GST must consist of the following mandatory fields:

- Name, Address and GSTIN of the supplier

- Invoice number(Unique serial number associated with financial year)

- Date of issuing Invoice

- a) Name, Address and GSTIN of the customer(if registered)

- b) Name, Address, Delivery address with state name and code(if unregistered & tax value more than Rs.50000)

- HSN code of Goods or Accounting Code of services

- Description of Goods or Services

- Quantity and Unit (in case of goods)

- Total Value of supply of goods or services along with discount(if any)

- Tax Rate

- Amount of tax charged in respect of taxable goods or services

- Place of Supply

- Delivery address(if differs from Place of Supply/Billing Address)

- Whether the tax is payable or reverse charge

- Signature or Digital Signature of the supplier

- For exports, the invoice must include the endorsement “Supply Meant for Export on Payment of IGST” (as per invoice type), along with the buyer’s name, address, delivery address, country, and export application details.

HSN is also not required if turnover is below 1.5 crores. If turnover is between 1.5 crore to 5 crores, only 2 digits of HSN code is required. But if turnover is above 5 crore, then 4 digits of HSN code will be required in invoices.

Time Limit to issue Invoice – Invoicing Under GST

As per the GST Act, there is a time limit to issue invoices based on the supply of goods/services.

In the case of supply of goods:

Tax invoice must be issued before or at the time of

- Removal of goods for supplying to recipient, where supply involves movement of goods.

- Delivery of goods to recipient, where supply does not require movement of goods.

- Issue of account payment/statement where there is a continuous supply.

In the case of supply of services:

- Tax invoice must be issued within 30 days from the service supply date.

- For banks or financial institutions, the tax invoice must be issued within 45 days of service supply.

Copies of GST Invoices Required:

The tax payer shall issue the invoice copies based on the below:

| Supply of Goods | Supply of Services |

|---|---|

| Original for recipient – Issued to receiver | Original for recipient – Issued to receiver |

| Duplicate for Transporter – Issued to transporter (Not mandatory if the supplier has invoice reference number from GST portal.) | Duplicate for Supplier – Issued to transporter. |

| Triplicate for Supplier – Retained the supplier | – |

Bill of Supply

A Bill of Supply is similar to a GST invoice but does not include tax amounts, as it is issued for exempted goods or services.

A registered supplier issues a Bill of Supply in the following cases:

- Supply of exempted goods/services.

- Supplier opted/comes under Composition scheme.