Are you still manually calculating revenue, tracking expenses & estimating profits? If so, you are still on the old ages of billing/accounting which consumes a lot of time & lead to human errors. It’s time to simplify your accounting. To make run your business easy & to do accurate accounting, upgrade to Computerized Accounting Software […]

Jewellery Billing Software is designed as a comprehensive retail solution for jewellery businesses, including wholesalers, manufacturers, and goldsmiths. It helps manage all aspects of jewellery shop accounting, including inventory management, barcode scanning, and POS systems. In today’s computerized world, using GST jewellery billing software at your retail shop can make your work easier and more […]

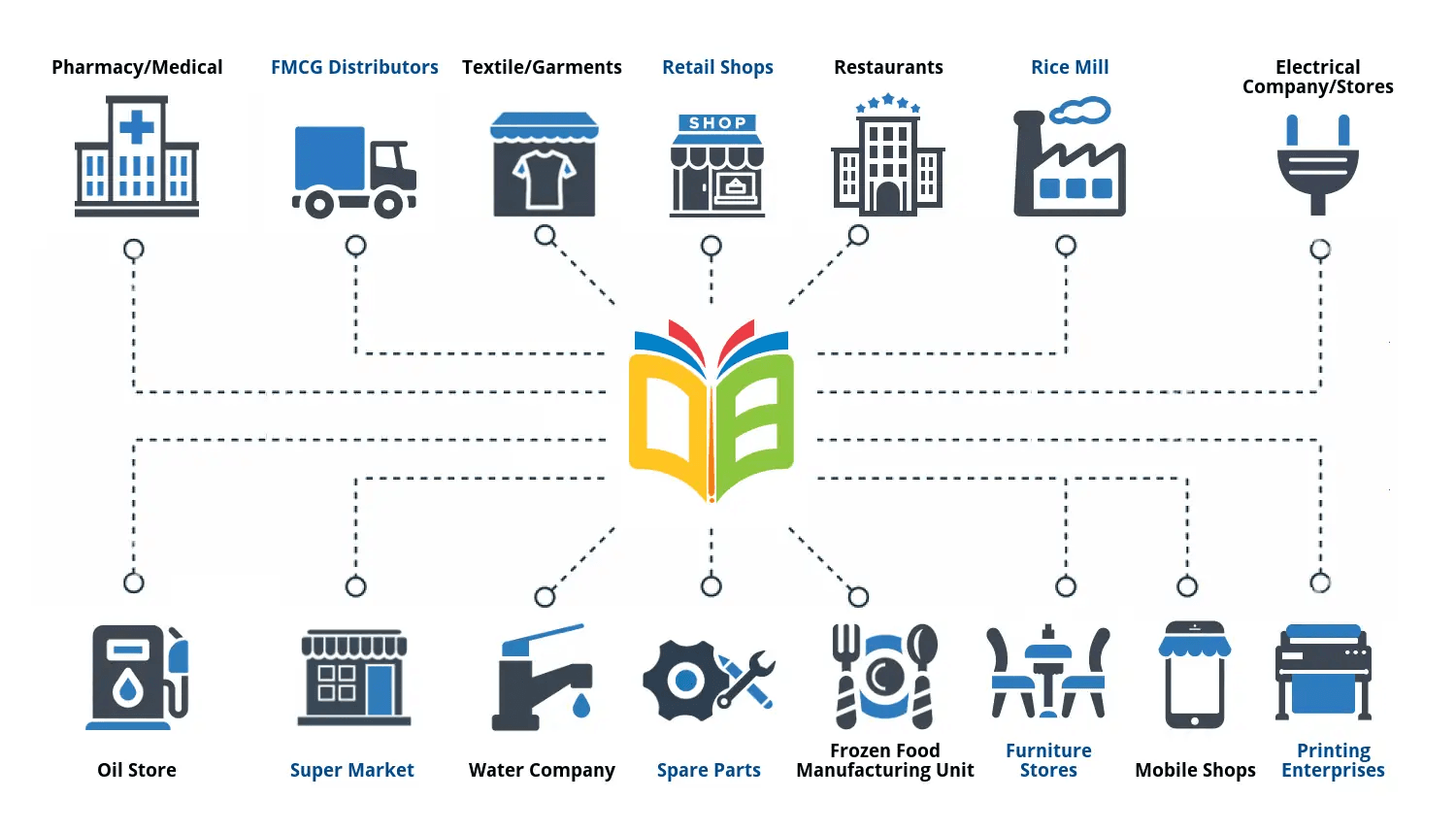

Billing & Invoicing Software is a software program (or) application that is designed to handle billable products and managing invoices of customers. It is an online/offline tool that is used to create bills/invoices, follow payments, bookkeeping, etc in a streamlined manner. It helps in managing multiple stores and multiple company billing system. Billing systems help […]

Technology has become more advanced and it is playing a very crucial role in almost every field with no surprise in accounting. Accounting represents the financial health of a business. When businesses get expanded, they will need proper bookkeeping without any shortcomings or mistakes. It is better to use the best accounting software to manage […]

Do you handle your clothing store accounting, inventory, expenses, revenues well? Are you feeling tired of handling your cash flow management? No more difficulty in dealing with bulk inventory stocks and heavy seasonal billings. To make sure that your garment shop business is successful, you must have a clear concern on your financial data and […]

Self-hosted billing software means the billing software which is running on-premise meaning the software and database is stored on a client-owned local server that can be accessed by people within the organization. Many Billing software can be hosted Online. Both Self hosted and Online hosted has its own advantages and disadvantages. Let us see how […]

What is GST? GST is a consumption-based tax levied on the sale, manufacture, and consumption of goods and services. It has replaced all indirect taxes previously levied by the central and state governments, making it a single unified tax for the entire country. CGST: GST is levied on intrastate supplies by the central government. SGST: […]

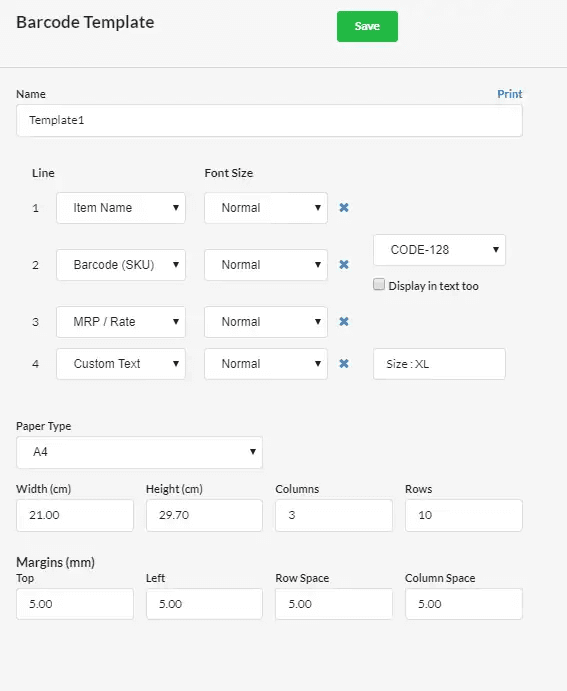

Maintaining an inventory with a large number of items & serving a large number of customers with a slow tedious billing process in a busy retail shop will affect the success of the retail shop. In such a fast-paced environment, manual inventory management & billing might cause human-errors that are more frustrating. This is where […]

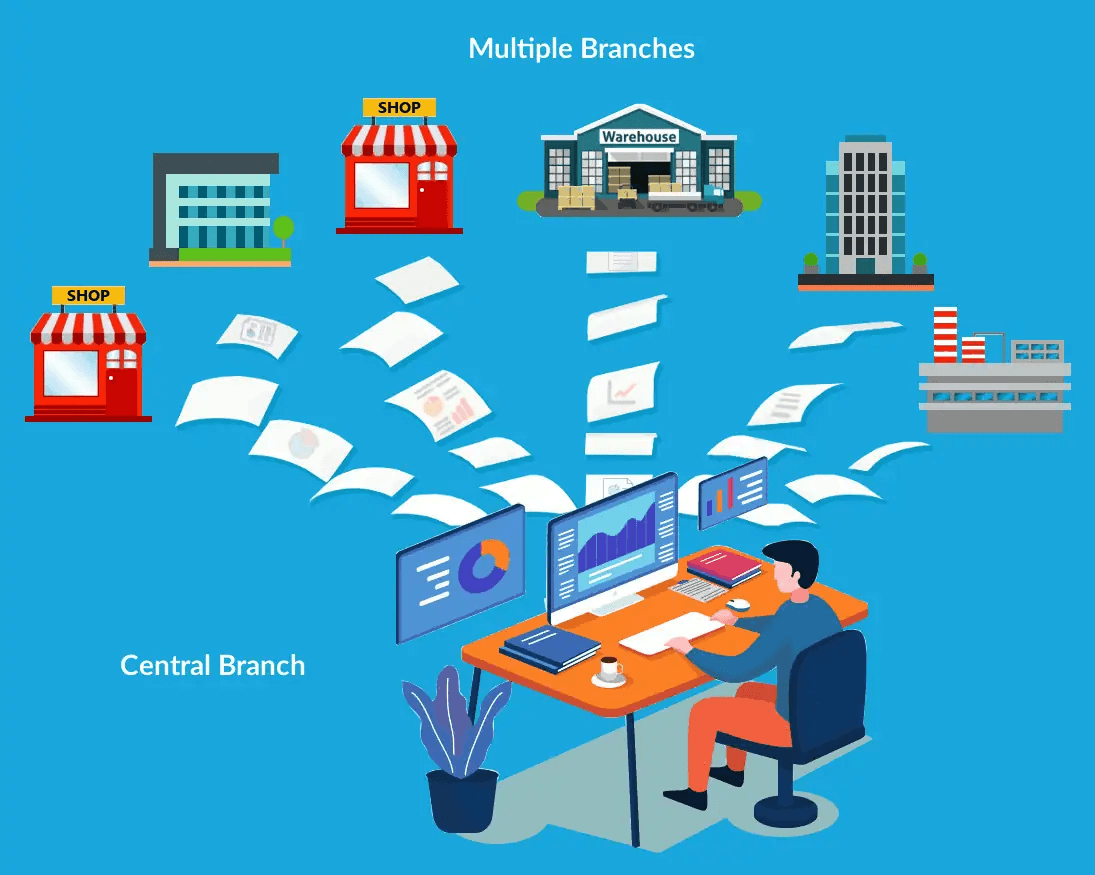

Managing the accounting of multiple branches across various locations presents significant challenges. Just by maintaining accounting data with your system will not make you have a clear cut analysis of your accounting at multiple branches. With the use of a software system dedicated to accounting, accounting work will become simpler and everything will stay well […]

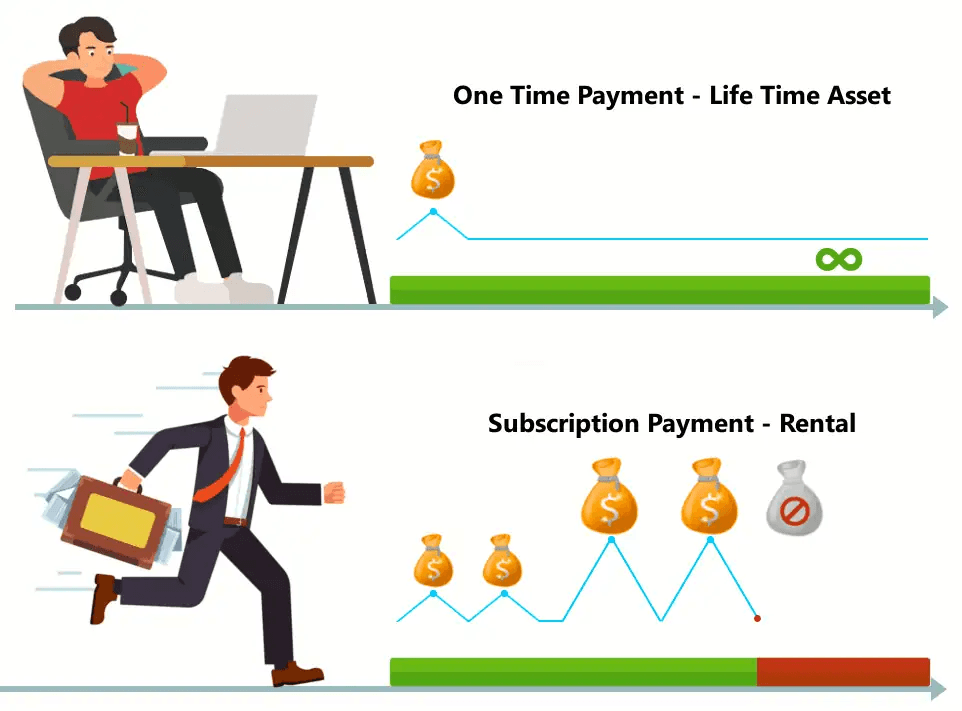

A one time purchase is similar to a single transaction. As the name indicates, it is obviously any product that you’ll likely only have to buy once. Buying one-time purchase products that will serve you for a lifetime sounds like a perfect business deal. Buyers prefer a one-time purchase while opting for a high-quality product […]