The emergence of digital technology has probably made many business companies upgrade to the electronic form of invoice processing.

However, there are certain requirements according to which the majority of the companies print the invoices received electronically.

- Requirement to adhere to the GST law which states to generate multiple copies of invoices

- Legal Requirements such as auditing or revenue reasons

- Physical evidence to prove that the financial transaction actually occurred.

Therefore, printing the hard copies of invoices is very much essential.

GST Rule on invoice issuing(Printing)

According to the GST law, it is necessary for the businesses to print multiple copies of all of their invoices.

Invoices for Supply of Goods

The invoice must be prepared in triplicate as follows:

- Original Copy for the use of the recipient

- Duplicate Copy for the use of the transporter

- Triplicate Copy for the use of the supplier

Invoices for Supply of Services

The invoice must be prepared in duplicate and clearly marked as:

- Original Copy for the use of the recipient

- Duplicate Copy for the use of the supplier

Why accounting software supports Dot matrix printer and thermal printer too?

Though many latest printers are evolved, still many business companies and retailers are preferring Dot matrix printer. It is because of its impact technology and its use in multi-part forms.

Also, thermal printer is best suitable for retail business and it is widely used.

That is why accounting software supports all types of printers for the invoicing process.

Output Books – Dot matrix / Thermal printer Billing Software

Output Books also supports all types of printers including Dot matrix printer and thermal printer. You can use it for printing quotes, invoices and retail invoices. You can also print multiple invoices.

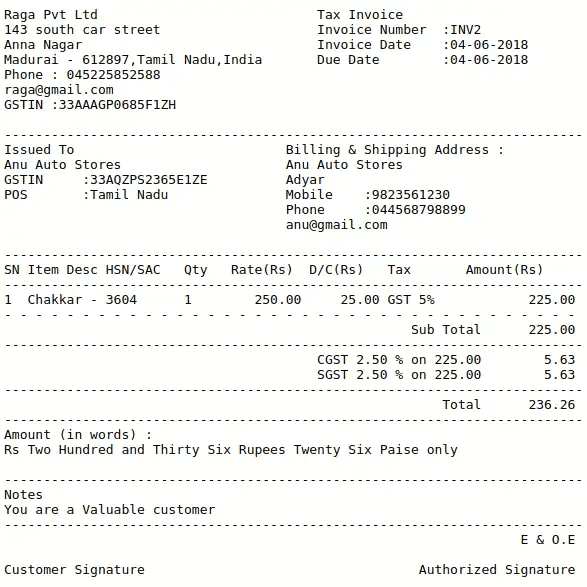

Dot matrix Printer Invoice Template

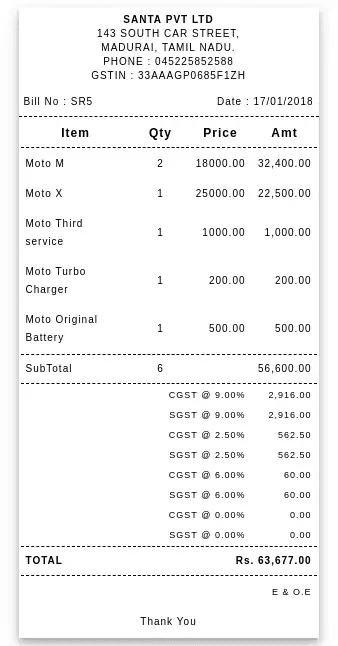

Thermal Printer Invoice Template

Finally, check out our Blog on Multi User accounting software

What are you waiting for! Jump in

Try Output books for free