In this blog we are going to see how to record profit / loss on the sale of fixed assets. When fixed asset of a firm are sold and if any profit is earned out of such sale then it will be shown in P/L account.

Fixed assets

Fixed assets are long-term assets that a company has purchased and is using for the production of its goods and services.

Fixed tangible assets can be depreciated over time to reduce the recorded cost of the asset. Most tangible assets, such as buildings, machinery, and equipment, can be depreciated.

Profit/Loss on the sale of fixed assets

The original purchase price of the asset, minus all accumulated depreciation, is the carrying amount of the asset. Subtract this carrying amount from the sale price of the asset. If the remainder is positive, it is a Profit. If the remainder is negative, it is a loss.

How to record the profit on the sale of fixed assets?

For example, ABC company sells its old machine for Rs.15,000 on Mar 8,2018. The machine was purchased at the cost of Rs.35,400 on Jan 8, 2014.

Record Depreciation

In order to have the machine’s carrying cost at the time of the sale, you must record the depreciation expenses upto the date of the sale of the asset. The machine’s carrying cost at the date of sale is calculated as below.

| Date | Opening Balance(Rs.) | Depreciation(Rs.) | Closing Balance(Rs.) |

|---|---|---|---|

| 31-03-2014 | 35400 | 6680 | 23320 |

| 31-03-2015 | 23320 | 4264 | 19056 |

| 31-03-2016 | 19056 | 3411 | 16645 |

| 31-03-2017 | 16645 | 2929 | 13716 |

| 31-03-2018 | 13716 | 2343 | 11373 |

To calculate the depreciation, refer our page, Journal entry for depreciation.

| Depreciation | Debit |

| Machine (Fixed assets) | Credit |

In the same manner, you have to record the depreciation for the succeeding years upto the date of the sale.

Record Profit

In this example, Machine’s carrying amount is Rs.11,373 and the machine is sold at the cost of Rs.15,000.

Sales Price – Machine’s carrying amount = 15,000 – 11,373 = 3,627

The remainder is positive. So it is profit.

The profit on the sale of the asset is recorded in the books as follows

| Account | Debit(Rs.) | Credit(Rs.) |

|---|---|---|

| Machine (Fixed assets) | 11,373 | |

| Cash A/C or Bank A/C | 15,000 | |

| Profit on the sale of asset | 3627 |

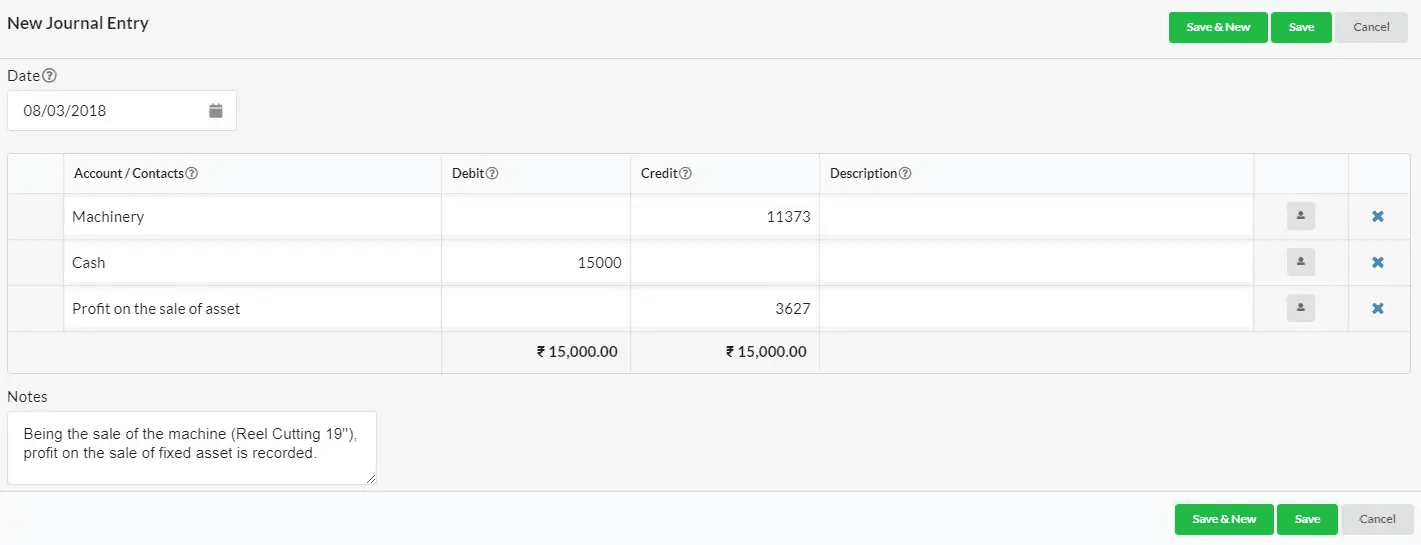

Record the profit on the sale of the fixed asset in Output Books

1. Create account head

- Go to Accounting > Chart of Accounts.

- Click New Account.

- Provide Profit on the sale of asset in Name

- Select Indirect Income in Group drop down.

- Click Save.

2. Post a journal entry on the date of sale