Tag - Multiple User Accounting Software

Posts by: administrator

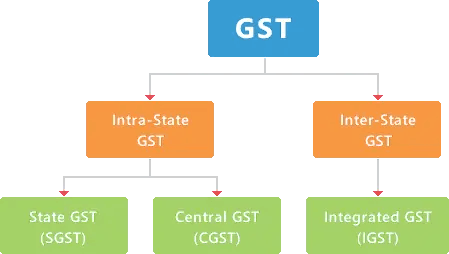

GST Accounting Entries

Goods & Service Tax(GST) Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services. GST is a destination-based tax that replaces earlier central taxes and duties such as excise duty, service tax, countervailing duty (CVD), special additional duty of customs (SAD), central charges, and local state taxes such […]

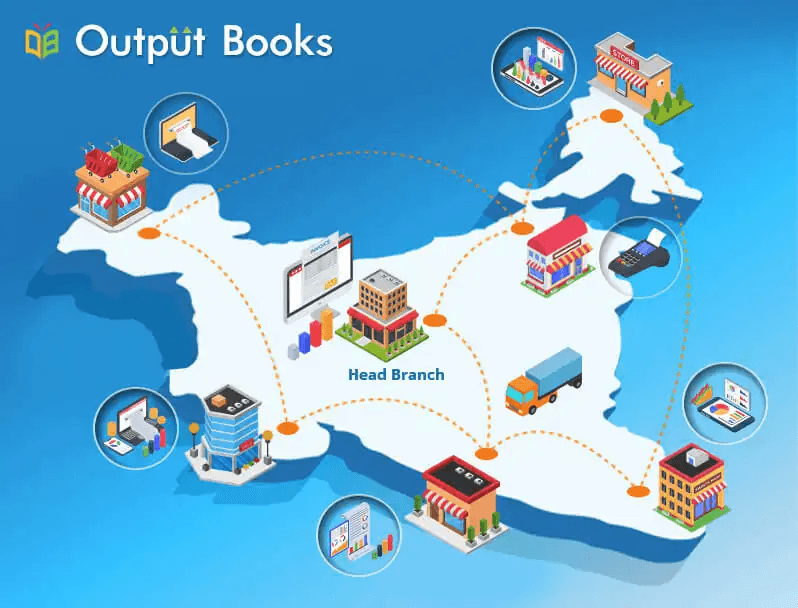

Multibranch Billing Software

Businesses with multiple branches aim to operate smoothly and efficiently across all locations. To successfully manage a multi-branch business, it is essential to track daily sales, stock, and cash flow at each branch. A single billing software solution that provides a complete package of billing, accounting, and inventory management can effectively support operations across multiple […]

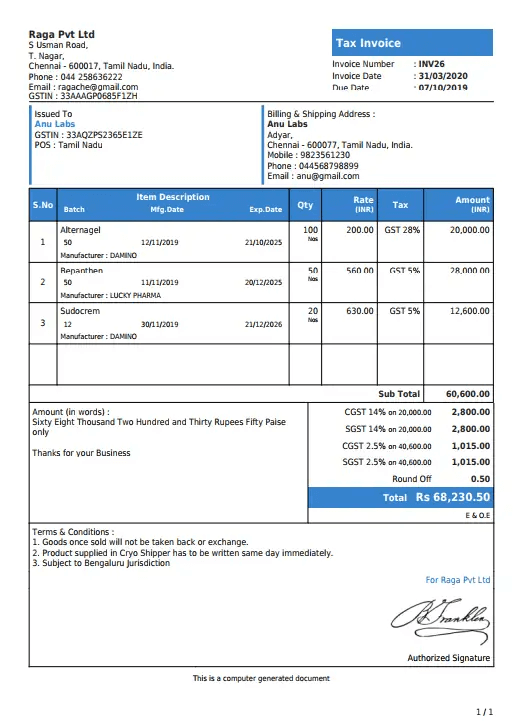

GST Invoice Format & Rules

A GST-registered dealer must issue a GST invoice or bill when supplying taxable goods or services. The invoice must comply with GST rules and regulations. It is typically used to charge tax and to claim input tax credit. GST billing and invoicing are made easy and simple with GST billing software. Invoices can be generated […]

Multi Branch Inventory Accounting Software

Managing the accounting of multiple branches across various locations presents significant challenges. Just by maintaining accounting data with your system will not make you have a clear cut analysis of your accounting at multiple branches. With the use of a software system dedicated to accounting, accounting work will become simpler and everything will stay well […]

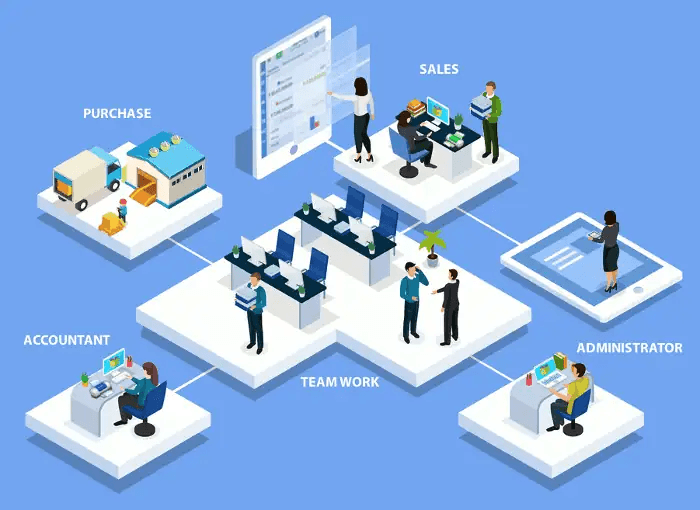

Multi-User Accounting Software

Spend your time in accounting wisely by making sure that every accounting base is covered with the right people doing the right jobs irrespective of their location/time/device. Unlimited multiple user logins can help to organize all the accounting bases with superior team coordination. Simultaneous access by multiple users Output Books can be accessed simultaneously by […]